Jumbo Loan: Tailored Mortgage Solutions for High-Income Borrowers

Jumbo Loan: Tailored Mortgage Solutions for High-Income Borrowers

Blog Article

Optimizing Your Home Purchasing Potential: An Extensive Look at Jumbo Financing Financing Options

Browsing the intricacies of jumbo finance financing can considerably boost your home purchasing potential, particularly for high-value buildings that surpass conventional financing limits. Understanding the qualification demands, consisting of the need for a robust credit scores score and substantial deposit, is vital for prospective purchasers (jumbo loan). Additionally, the competitive landscape of rates of interest and linked charges presents both challenges and opportunities. As you consider these elements, the inquiry stays: just how can you strategically position yourself to maximize these funding options while decreasing risks?

Recognizing Jumbo Finances

In the realm of home loan financing, big lendings work as a vital option for consumers looking for to acquire high-value residential or commercial properties that go beyond the conforming loan limitations established by government-sponsored business. Typically, these limitations differ by region and are established every year, typically reflecting the local housing market's dynamics. Big lendings are not backed by Fannie Mae or Freddie Mac, which identifies them from standard finances and presents various underwriting requirements.

These finances usually include greater passion rates because of the perceived risk related to larger financing quantities. Customers that choose big financing normally call for a more substantial monetary profile, consisting of greater credit score ratings and lower debt-to-income proportions. In addition, jumbo car loans can be structured as adjustable-rate or fixed-rate home mortgages, permitting customers to pick a payment strategy that aligns with their monetary objectives.

The relevance of big finances expands past plain financing; they play a crucial duty in the deluxe actual estate market, enabling purchasers to acquire residential properties that stand for considerable investments. As the landscape of home mortgage options progresses, comprehending big car loans ends up being necessary for navigating the complexities of high-value property purchases.

Qualification Demands

To receive a jumbo lending, borrowers should fulfill specific qualification needs that differ from those of standard financing. One of the primary requirements is a greater debt rating, usually needing a minimum of 700. Lenders analyze creditworthiness rigorously, as the raised car loan amounts involve better risk.

In addition, jumbo loan applicants generally require to supply evidence of substantial revenue. Lots of lenders choose a debt-to-income ratio (DTI) of 43% or reduced, although some may enable approximately 50% under certain scenarios. This makes certain borrowers can manage their month-to-month payments without monetary stress.

In addition, considerable properties or books are usually called for. Lenders may request for at the very least 6 months' worth of home loan payments in fluid possessions, demonstrating the customer's capacity to cover expenses in case of revenue interruption.

Finally, a bigger down payment is popular for big finances, with many loan providers expecting at the very least 20% of the acquisition rate. This need minimizes threat for lenders and suggests the consumer's dedication to the investment. Meeting these strict qualification requirements is important for safeguarding a big car loan and effectively browsing the high-end realty market.

Rates Of Interest and Costs

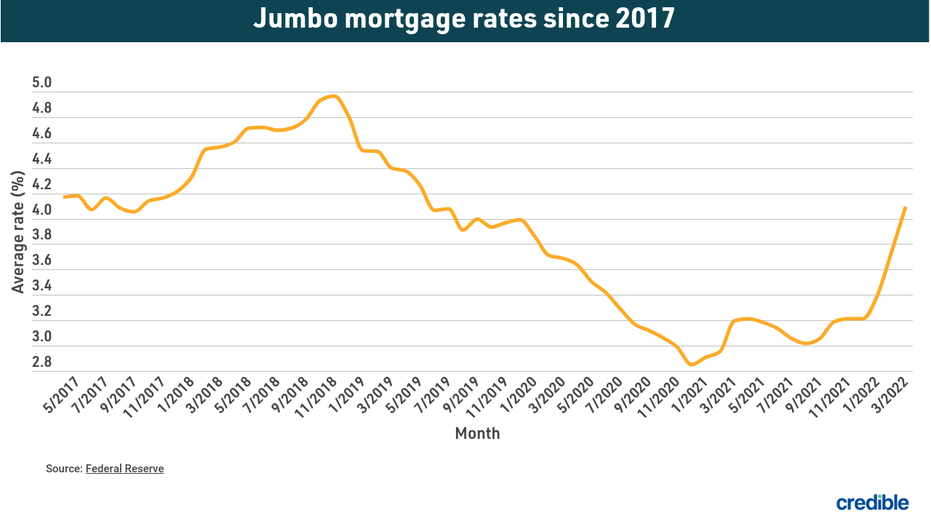

Recognizing the details of interest prices and costs connected with jumbo financings is essential for potential debtors. Unlike adhering lendings, big financings, which exceed the adhering loan limitations set by Fannie Mae and Freddie Mac, generally come with greater passion rates. This increase is attributable to the perceived threat lenders take on in moneying these bigger car loans, as they are not backed by government-sponsored ventures.

Rate of interest can vary considerably based upon several aspects, including the borrower's credit report, the loan-to-value proportion, and market conditions. It is important for debtors to look around, as different lending institutions might supply varying rates and terms. Additionally, jumbo car loans might involve greater charges, such as origination costs, appraisal charges, and exclusive mortgage insurance policy (PMI) if the down payment is less than 20%.

To reduce costs, debtors should carefully assess the cost structures of different lenders, as some might provide lower rates of interest but greater costs, while others may supply a much more balanced strategy. Ultimately, understanding these parts helps customers make educated decisions and optimize their financing alternatives when acquiring deluxe properties.

Advantages of Jumbo Loans

Jumbo car loans supply substantial advantages for purchasers looking for to buy high-value buildings. Among the primary benefits is that they offer accessibility to funding that surpasses the conforming finance limitations established by the Federal Housing Finance Firm (FHFA) This enables customers to protect larger lending amounts, making it possible to get lavish homes or residential or commercial properties in extremely sought-after locations.

Additionally, big car loans frequently come with competitive rates of interest, particularly for debtors with strong credit history profiles. This can cause significant savings over the life of the financing. Jumbo fundings typically allow for a variety of lending terms and structures, using versatility to customize the financing to fit specific long-term objectives and economic circumstances.

One more trick benefit is the capacity for lower deposit demands, depending on the lending institution and debtor certifications. This enables buyers to enter the premium property market without needing to devote a significant in advance funding.

Lastly, jumbo fundings can offer the opportunity for greater cash-out refinances, which can be helpful for home owners wanting to touch right into their equity for various other investments or major costs - jumbo loan. In general, big fundings can be an efficient tool for those browsing the upper tiers of the housing market

Tips for Protecting Financing

Protecting funding for a big car loan requires careful prep work and a strategic method, particularly given the unique characteristics of these high-value home mortgages. Begin by assessing your economic wellness; a robust credit rating, commonly over 700, is important. Lenders view this as a sign of reliability, which is essential for big fundings that go beyond adjusting lending limitations.

Involving with a home mortgage broker experienced in review jumbo lendings can offer useful understandings and accessibility to a wider range of lending choices. By complying with these suggestions, you can boost your possibilities of efficiently securing funding for your big car loan.

Verdict

In verdict, jumbo fundings provide distinct advantages for purchasers seeking high-value homes, provided they fulfill details eligibility criteria. With requirements such as a solid debt rating, reduced debt-to-income ratio, and considerable down settlements, possible homeowners can access high-end property possibilities. By comparing rates of interest and working together with seasoned home mortgage brokers, people can improve their home acquiring prospective and make notified economic choices in the competitive realty market.

:max_bytes(150000):strip_icc()/dotdash-jumbo-vs-conventional-mortgages-how-they-differ-v2-75c8bd243a054517aa21385ef266c11d.jpg)

Navigating the intricacies of big loan financing can considerably improve your home getting possible, especially for high-value residential properties that exceed conventional car loan limitations.In the world of home loan funding, big fundings offer as an essential option for debtors looking for to purchase high-value homes that exceed the adhering funding limitations set by government-sponsored business. Unlike conforming lendings, jumbo fundings, which exceed the adapting finance restrictions set by Fannie Mae and Freddie Mac, generally come with greater passion rates. Jumbo loans usually my response enable for a variety of loan terms and structures, supplying flexibility to customize the financing to fit private monetary scenarios and long-term goals.

Lenders sight this as an indicator of reliability, which is vital for jumbo finances that exceed conforming funding limits. (jumbo loan)

Report this page